skilpod.com / blog

affordable building — reduced VAT rate of 6% for demolition and reconstruction in 2024

In recent years, under certain conditions, you could enjoy a reduced VAT rate of 6% when you demolished an old home and built a new one on the same site. In 2024, the rules have been adjusted and, more importantly, simplified.

what is demolition and reconstruction?

As the name implies, it involves projects where you demolish an old building, no longer suitable for renovation, and build a new home on the same plot. It does not matter if the old building was previously a home or had another use. Although it must be a building of significant size, proportional to the dwelling you want to build afterwards. Simply tearing down a shed or a chicken coop will not suffice.

To qualify for the favorable VAT treatment, the demolition and reconstruction must be done by the same person. However, you may use a contractor to do this. Like Skilpod, for example.

what are the conditions to benefit from the reduced VAT rate?

From 2024, the same conditions will apply throughout Belgium:

- The builder is a natural person

- The new home is your own and only home for 5 years. You must be domiciled there.

- The maximum living area is 200m2

If you build a home that will serve as social housing for 15 years, you can also benefit from the preferential rate.

what rules apply in center cities?

Similar rules used to apply in 32 center cities. As a natural person, you could enjoy the advantageous 6% rate on all demolition and reconstruction projects. Without the additional conditions that are there today.

With the new legislation, that separate arrangement will be abolished. The same conditions will apply nationwide. There is still a transitional measure for projects for which a permit has already been submitted, but if you are starting a new demolition-and-reconstruction project, this will have no impact on you.

does this regulation apply if I purchase a Skilpod?

Yes, at least if you meet the above conditions. If you are a private individual who owns a building plot with a building to be demolished and you want to put a Skilpod on it to live in yourself, you are eligible for the preferential VAT rate. In this case, you are the builder (natural person) and we are the contractor.

If you want, we can also take care of the demolition and preparation of your plot. Please note that this is not included in our standard price. If you would like a quote, be sure to contact us.

more about our building process

smart building — a spectacular installationWhat do you do when the construction site is in an inaccessible location and your client still wants a Skilpod? Cut a deal with the neighbors.

smart building — 11 homes in 4 daysWe did it again. At the historical site of the Chocolate Factory in Tongeren, we built 11 new homes in 4 days.

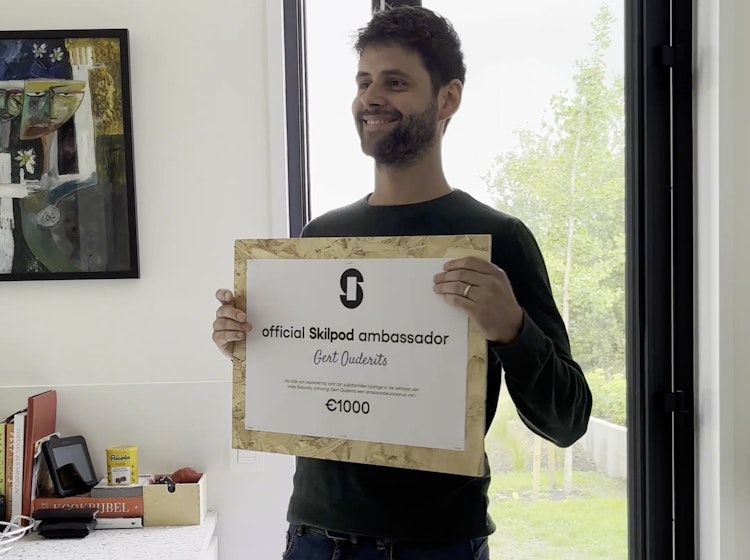

building process — what is the Skilpod ambassador bonus?Of course we love it when our fans recommend us to other people. So much so that we decided to give them a reward: the ambassador bonus